Featured

Table of Contents

- – How long does Level Term Life Insurance covera...

- – What is the most popular Level Term Life Insur...

- – What is Guaranteed Level Term Life Insurance?

- – What is a simple explanation of Level Term Li...

- – Why should I have Level Term Life Insurance ...

- – How can I secure Compare Level Term Life Ins...

Adolescent insurance gives a minimum of security and can provide protection, which may not be offered at a later date. Quantities provided under such coverage are usually minimal based on the age of the kid. The present restrictions for minors under the age of 14.5 would be the greater of $50,000 or 50% of the amount of life insurance coverage in pressure upon the life of the applicant.

Juvenile insurance coverage may be offered with a payor benefit biker, which offers waiving future premiums on the youngster's policy in case of the death of the person who pays the premium. Elderly life insurance policy, occasionally described as graded fatality advantage plans, offers eligible older candidates with marginal entire life protection without a medical exam.

The maximum issue amount of insurance coverage is $25,000. These policies are generally more expensive than a totally underwritten policy if the individual qualifies as a typical danger.

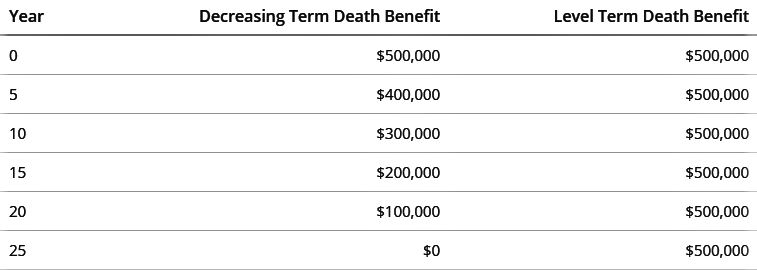

Our term life options consist of 10, 15, 20, 25, 30, 35, and 40-year plans. The most popular type is level term, meaning your repayment (premium) and payout (survivor benefit) remains degree, or the very same, up until completion of the term duration. This is one of the most uncomplicated of life insurance policy alternatives and calls for very little upkeep for policy proprietors.

How long does Level Term Life Insurance coverage last?

For instance, you could offer 50% to your spouse and split the rest amongst your grown-up youngsters, a moms and dad, a friend, or perhaps a charity. * In some instances the death benefit might not be tax-free, learn when life insurance coverage is taxable

1Term life insurance coverage offers momentary defense for an essential duration of time and is generally more economical than permanent life insurance policy. 2Term conversion standards and limitations, such as timing, might use; for instance, there might be a ten-year conversion advantage for some items and a five-year conversion benefit for others.

3Rider Insured's Paid-Up Insurance policy Purchase Alternative in New York City. 4Not readily available in every state. There is a cost to exercise this rider. Products and riders are offered in approved jurisdictions and names and features may differ. 5Dividends are not guaranteed. Not all taking part plan proprietors are qualified for dividends. For pick bikers, the problem puts on the insured.

What is the most popular Level Term Life Insurance Premiums plan in 2024?

We might be made up if you click this advertisement. Ad Degree term life insurance coverage is a policy that offers the same survivor benefit at any kind of point in the term. Whether you pass away on the very same day you get a plan or the last, your recipients will certainly get the same payment.

Policies can additionally last up until specified ages, which in a lot of instances are 65. Past this surface-level info, having a better understanding of what these plans involve will certainly aid ensure you buy a policy that satisfies your needs.

Be conscious that the term you select will certainly influence the premiums you spend for the policy. A 10-year level term life insurance plan will certainly cost less than a 30-year policy due to the fact that there's much less chance of a case while the strategy is active. Lower threat for the insurance firm equates to lower costs for the insurance holder.

What is Guaranteed Level Term Life Insurance?

Your household's age should additionally influence your policy term option. If you have little ones, a longer term makes feeling due to the fact that it safeguards them for a longer time. Nevertheless, if your youngsters are near the adult years and will certainly be monetarily independent in the future, a much shorter term could be a far better suitable for you than a prolonged one.

However, when comparing entire life insurance coverage vs. term life insurance policy, it deserves noting that the last typically prices much less than the former. The outcome is more insurance coverage with lower premiums, supplying the very best of both globes if you need a significant amount of coverage however can't manage a much more expensive plan.

What is a simple explanation of Level Term Life Insurance Calculator?

A degree death advantage for a term policy normally pays as a round figure. When that takes place, your heirs will certainly receive the entire quantity in a solitary payment, which quantity is ruled out revenue by the IRS. Those life insurance proceeds aren't taxed. Level premium term life insurance. Nonetheless, some level term life insurance policy firms enable fixed-period repayments.

Interest payments obtained from life insurance policy policies are thought about earnings and undergo tax. When your level term life policy ends, a few various things can take place. Some coverage terminates immediately without choice for revival. In various other circumstances, you can pay to prolong the strategy beyond its original date or transform it into a long-term plan.

The drawback is that your sustainable level term life insurance coverage will certainly come with greater costs after its first expiration. We might be made up if you click this ad.

Why should I have Level Term Life Insurance Policy Options?

Life insurance coverage firms have a formula for calculating threat using death and passion. Insurance companies have hundreds of clients taking out term life plans simultaneously and use the costs from its energetic policies to pay enduring recipients of various other policies. These firms utilize mortality to approximate how many individuals within a particular group will file death cases annually, and that information is used to identify typical life span for possible insurance policy holders.

Additionally, insurance policy firms can invest the money they get from premiums and enhance their revenue. The insurance firm can invest the money and earn returns - Low cost level term life insurance.

The following section information the pros and disadvantages of level term life insurance coverage. Predictable premiums and life insurance policy coverage Simplified plan framework Possible for conversion to permanent life insurance policy Limited insurance coverage duration No cash worth buildup Life insurance policy costs can boost after the term You'll discover clear benefits when comparing degree term life insurance policy to various other insurance policy kinds.

How can I secure Compare Level Term Life Insurance quickly?

You always recognize what to expect with inexpensive level term life insurance policy coverage. From the moment you obtain a policy, your costs will certainly never change, helping you prepare monetarily. Your protection will not differ either, making these plans efficient for estate planning. If you value predictability of your settlements and the payouts your heirs will certainly receive, this sort of insurance policy could be a great fit for you.

If you go this course, your costs will certainly increase but it's always excellent to have some flexibility if you wish to keep an active life insurance policy plan. Renewable degree term life insurance policy is an additional alternative worth considering. These plans enable you to maintain your current strategy after expiry, providing flexibility in the future.

Table of Contents

- – How long does Level Term Life Insurance covera...

- – What is the most popular Level Term Life Insur...

- – What is Guaranteed Level Term Life Insurance?

- – What is a simple explanation of Level Term Li...

- – Why should I have Level Term Life Insurance ...

- – How can I secure Compare Level Term Life Ins...

Latest Posts

Funeral & Final Expense Insurance

Instant Approval Life Insurance

Life Insurance Quotes Instant

More

Latest Posts

Funeral & Final Expense Insurance

Instant Approval Life Insurance

Life Insurance Quotes Instant